The Truth About Form 6765: What Most Businesses Get Wrong About R&D Credits

Form 6765 has seen its biggest changes in over a decade. These changes are catching many businesses off guard. Most companies don’t realize they can apply 6% to 8% of their yearly qualifying R&D expenses directly against their federal income tax liability when filing for R&D tax credits.

The era of broad, combined R&D credit claims has ended. The updated form requires much more qualitative data with tax returns. Companies must now measure research credit QREs based on each “business component”. These changes matter especially when you have eligible startups and small businesses that could claim up to $250,000 per year against their payroll taxes.

Let’s get into what Form 6765 really is. We’ll cover the common mistakes businesses make during filing and the crucial changes coming in 2025. You’ll also learn practical strategies to keep your R&D tax credit claims compliant with new rules while getting the most from your tax benefits.

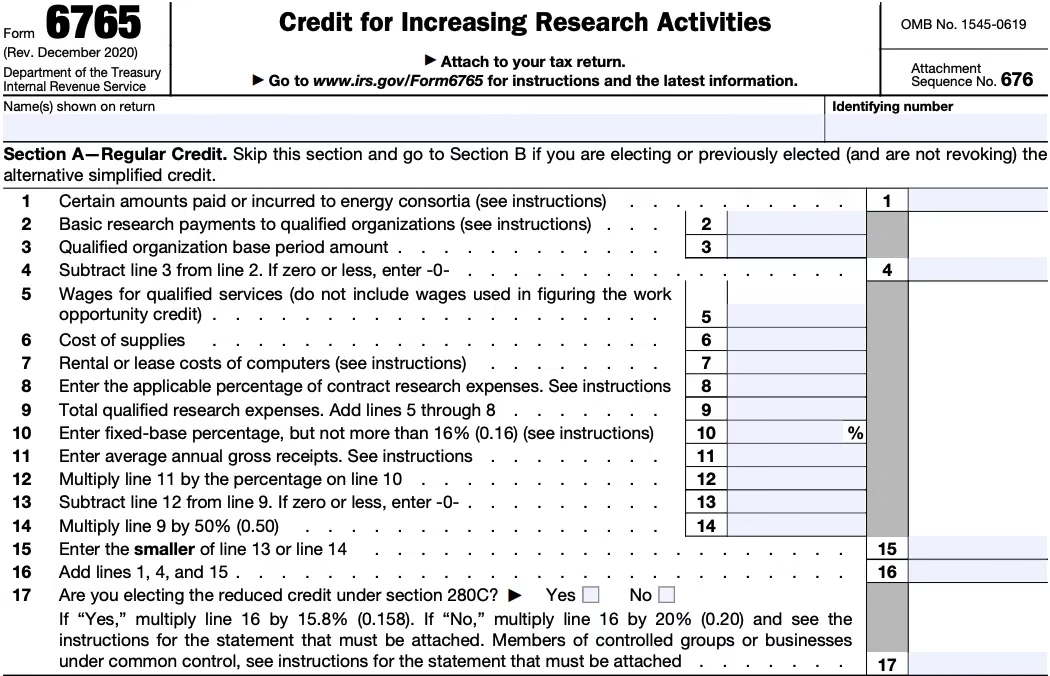

What is Form 6765 and why it matters

Image Source: Kruze Consulting

“The R&D credit means that organizations that invest in qualified research and development activities to incentivize innovation and growth (as defined in Internal Revenue Code section 41) may be eligible for a general business tax credit.” — Internal Revenue Service, U.S. Department of Treasury – Official IRS Guidance

The IRS Form 6765, “Credit for Increasing Research Activities,” helps businesses get valuable tax benefits when they invest in innovation. This form lets companies access one of the biggest tax incentives available to American businesses today.

Understanding the purpose of Form 6765

The form serves three main goals for businesses that do research activities. Companies can calculate and claim the Research and Development (R&D) tax credit. They can use this form to elect the reduced credit under section 280C. The form also lets eligible businesses elect and figure the payroll tax credit.

This single document helps businesses tell the IRS about their qualifying expenses and shows how they plan to use these credits for better tax advantages.

Who needs to file it and when

Partnerships and S corporations must file Form 6765 to claim the credit. Other businesses that get this credit only from a partnership, S corporation, estate, or trust can report it directly on Form 3800 (General Business Credit) instead.

Filing dates line up with standard tax deadlines—usually April 15th—though extensions might push this to October 15th. Filing on time is vital since missing the deadline could mean losing the chance to collect up to $500,000 in payroll tax credits.

The form also needs specific supporting information for refund claims that include section 41 credits to be valid.

How it connects to the R&D tax credit

Form 6765 lets businesses access the R&D tax credit—a powerful incentive that cuts federal income tax liability dollar-for-dollar.

Eligible small businesses can use the credit against both regular and alternative minimum tax if their gross receipts are under $5 million in the taxable year and they had no gross receipts before the five-year period ending with the taxable year.

Qualified small businesses can choose to use up to $500,000 of their research credit against the employer’s portion of social security liability through the payroll tax credit election. This option is great for startups and small businesses that might not have enough income tax liability to use the credit otherwise.

The most common mistakes businesses make

Image Source: Smart.DHgate

Claiming R&D tax credits on Form 6765 looks simple at first glance. Many businesses end up making serious mistakes that put their claims at risk or miss out on potential benefits. Let’s get into these common pitfalls.

Misunderstanding what qualifies as R&D

A lot of companies think R&D credits only apply to lab-based research – this is a risky mistake. The tax credit definition actually covers many more activities than you might expect. The qualifying work starts right from concept development and goes all the way to pre-commercial release. Activities like prototype development, engineering new products, or creating experimental models usually qualify even without the typical “lab coat” setting.

Failing the IRS four-part test

The IRS needs all qualified research to meet four specific criteria at once. Your expenditures must qualify under section 174, which means they should eliminate uncertainty. The research needs to be technological, based on physical or biological sciences, engineering, or computer science. It must help develop a new or improved business component. The activities should also follow an experimental process for qualified purposes. Missing just one of these requirements will disqualify everything.

Over-aggregating business components

A business component means any product, process, software, technique, formula, or invention you want to sell, lease, or license. Companies often define these components too broadly just to make reporting easier. This strategy can backfire badly – if a broad component gets rejected, you could lose the whole claim. The components need specific technical definitions that line up with your research goals.

Inadequate documentation and time tracking

The biggest problem comes from poor record-keeping of R&D activities. These days, the IRS wants live records instead of after-the-fact paperwork. While you don’t strictly need timesheets, HMRC expects you to have systems that track how your team spends their time. Using the same percentage split for everyone’s time is a red flag now. The new form needs detailed breakdowns showing direct research time versus supervision.

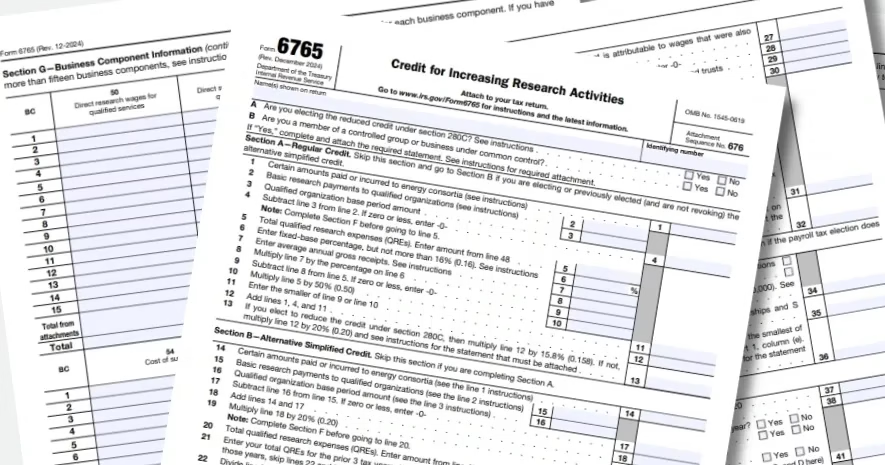

What changed in Form 6765 for 2024 and 2025

Image Source: Trout CPA

“The IRS has introduced significant changes to Form 6765 – Credit for Increasing Research Activities, the form businesses use to claim the Research and Development (R&D) tax credit. The updated version includes new requirements for both quantitative and qualitative data, meaning businesses must provide additional information related to their R&D activities.” — Kaufman Rossin, Accounting and Tax Advisory Firm

The most important overhaul since 2009 comes with the June 2024 revision of Form 6765. These changes want to make tax reporting consistent. The IRS resources will be managed efficiently while improving information quality.

Overview of new Sections E, F, and G

Form 6765 has three new sections. Section E (Other Information) needs disclosure of business components that generate QREs and officer wages in claims. It also asks whether new expense categories were added. Section F (Qualified Research Expenses Summary) takes the place of previous expense breakdowns. Section G (Business Component Information) needs detailed activity reports by business component. This section remains optional for 2024 but becomes mandatory for most filers in 2025.

Section G: Business component reporting explained

Taxpayers must report their “80%/Top 50” business components in this vital section. These components represent 80% of total QREs or up to 50 business components listed by QRE amount in descending order. The remaining components are combined by entering “Aggregate Business Components” in column 49(c). Software components need specification as internal use, dual function, non-internal use, or components excepted from internal use treatment.

Who is exempt from Section G

Section G exempts two categories of taxpayers:

- Qualified Small Businesses (QSBs) that choose the payroll tax credit

- Companies with QREs of $1.50 million or less AND gross receipts of $50.00 million or less (both at the controlled group level)

How statistical sampling rules have changed

Statistical sampling users must report 80% of total QREs or 50 business components “irrespective of which business components were used for the statistical sample”. The word “sample” must be added to component names in column 49(c) for sampled components. Their statistical sampling plan needs attachment.

Controlled group reporting requirements

Credit calculations treat all members of a controlled group as one taxpayer. Each member receives credit based on their share of the combined QREs. Members using different methods than the designated member should file amended returns. Group members who file separately report their QREs only, not the total group amount.

How to avoid errors and stay compliant

Businesses must take a proactive rather than reactive approach to handle the complexities of Form 6765. The IRS continues to tighten requirements, making it essential for companies to have well-laid-out methods for their claims.

Start with a business component framework

Your first step should be setting clear criteria to identify business components. Broad definitions often fail under IRS review. Projects need breaking down into auditable elements that show specific innovation and match research goals. The shrink-back rule helps narrow component scope when faced with challenges.

Track QREs in real time

Contemporaneous documentation is a vital part of the process – trying to reconstruct details later makes audits harder to defend. Your systems should capture decisions and technical challenges right away. This helps distinguish between direct research, supervision, and support work.

Use the right method: Regular vs. ASC

The best approach is calculating credits through both methods:

- Regular method (20%) benefits companies with low base amounts or startups

- ASC method (14%) works better for businesses with high base amounts or incomplete historical data

Use technology for documentation

Project management tools like Jira and Asana should merge with payroll and accounting software. This automatic tracking of QREs by business component creates strong documentation that connects expenses to qualified activities.

Coordinate across departments

Success depends on building strong teams that include technical leads, project managers, and finance staff. Tax teams can’t provide all the technical details needed for Section G compliance on the R&D tax credit form by themselves.

Conclusion

Form 6765 has changed by a lot for 2024-2025. This change marks the biggest update in over a decade. Companies need to adapt how they handle their R&D tax credit claims to avoid getting disqualified. Simple combined reporting no longer works. Companies must now provide detailed business component documentation and exact expense allocation.

New Sections E, F, and G need more qualitative data than before. Section G asks companies to report on “80%/Top 50” business components. Some qualified small businesses and companies with lower QREs and gross receipts don’t need to meet this rule.

Learning what counts as R&D is crucial to making successful claims. Many businesses think R&D only happens in labs, yet many development activities can qualify. These activities must pass the four-part IRS test – a step where many applications fail each year.

Smart businesses create clear frameworks to identify business components. They set up up-to-the-minute tracking systems for qualifying expenses and get departments to work together. Project management and accounting systems working together can build solid documentation that connects expenses to qualified activities.

Working out credits using both regular and ASC methods helps find the biggest benefit for your case. Small businesses and startups should look at how they can use up to $250,000 annually against payroll taxes if they don’t have enough income tax liability.

R&D tax credit remains one of the best incentives for innovative American businesses. Form 6765 might be harder to fill now, but companies that update their documentation and understand these new rules will keep getting this tax advantage while meeting IRS rules.

Key Takeaways

Form 6765 has undergone its most significant overhaul in over a decade, introducing new compliance requirements that many businesses aren’t prepared to handle. Here are the essential insights every company claiming R&D tax credits needs to understand:

• New Section G requires detailed business component reporting starting 2025 – Companies must report their “80%/Top 50” business components with specific QRE breakdowns, ending the era of high-level aggregated claims.

• Real-time documentation is now critical for compliance – The IRS expects contemporaneous records rather than retroactive reconstruction, making integrated tracking systems essential for defensible claims.

• Many businesses misunderstand what qualifies as R&D activities – Qualifying work extends far beyond lab research to include prototype development, engineering new products, and experimental models through pre-commercial stages.

• All activities must pass the IRS four-part test simultaneously – Research must be technological in nature, eliminate uncertainty, develop business components, and constitute experimentation – failure on any part disqualifies the entire claim.

• Small businesses can claim up to $250,000 annually against payroll taxes – Qualified small businesses with under $5 million in gross receipts can apply R&D credits directly against employer social security liability when income tax liability is insufficient.

The key to success lies in establishing proper business component frameworks, implementing real-time expense tracking, and coordinating efforts across technical and finance departments before the new requirements become mandatory.

FAQs

Q1. What are the major changes to Form 6765 for 2024 and 2025? The most significant changes include the addition of new Sections E, F, and G, which require more detailed reporting of business components and qualified research expenses. Section G, in particular, mandates reporting on “80%/Top 50” business components, becoming mandatory for most filers in 2025.

Q2. Who is exempt from completing Section G of Form 6765? Two categories of taxpayers are exempt: Qualified Small Businesses (QSBs) who elect the payroll tax credit, and companies with Qualified Research Expenses (QREs) equal to or less than $1.50 million AND gross receipts equal to or less than $50.00 million.

Q3. What are common mistakes businesses make when filing for R&D tax credits? Common mistakes include misunderstanding what qualifies as R&D, failing the IRS four-part test, over-aggregating business components, and maintaining inadequate documentation and time tracking for research activities.

Q4. How can businesses ensure compliance with the new Form 6765 requirements? To ensure compliance, businesses should start with a clear business component framework, track QREs in real-time, use the appropriate credit calculation method (Regular or ASC), leverage technology for documentation, and coordinate efforts across departments.

Q5. What benefits can small businesses gain from the R&D tax credit? Eligible small businesses can claim up to $250,000 per year against their payroll taxes. This is particularly beneficial for startups and small businesses that may not have sufficient income tax liability to utilize the credit otherwise.