The Hidden Truth About Liquidity Optimization in Modern Supply Chains

Cash flow and liquidity risk ranks among the top ten global risks for 2025 and will likely persist through 2028. Businesses managing complex supply chains now see liquidity optimization as essential for survival rather than just a financial target.

Companies of all sizes face budget constraints due to rising interest rates, inflation, tariffs, and volatile market conditions. These challenges make it harder to keep operations healthy while pursuing growth initiatives. The statistics paint a concerning picture – 29% of organizations experienced losses from cash flow and liquidity risks last year. Small businesses feel this impact directly since their borrowing capacity determines their ability to maintain inventory and keep operations running.

Immediate visibility into cash positions plays a vital role in treasury optimization. Companies can create powerful opportunities to maintain liquidity and build stronger supplier relationships by combining this visibility with supply chain finance programs. These programs currently serve over two million suppliers and operate in more than 48 countries.

This piece examines how modern liquidity optimization approaches can turn your supply chain from a cash drain into a strategic asset. The right strategies help organizations navigate economic uncertainty while building foundations for growth.

The growing liquidity challenge in modern supply chains

Image Source: NetSuite

“Many supply chains are perfectly suited to the needs that the business had 20 years ago.” — Jonathan Byrnes, Senior Lecturer at MIT & Supply-Chain Author

Supply chains worldwide face unprecedented liquidity challenges. U.S. business logistics costs hit a record $2.60 trillion in 2025, making up 8.7% of national GDP. This represents a 5.4% increase from last year. Businesses struggle to maintain healthy cash reserves in this perfect storm.

Rising costs and economic uncertainty

Supply chain costs will likely climb 7% above inflation by Q4 2025. Last year saw just a 2% increase. Companies must make tough choices as their stockpiled inventories run low. They can either protect their margins or keep customer prices stable. Raw materials, transportation, and labor costs keep rising, which puts pressure on profit margins across industries.

The numbers paint a stark picture. S&P Global predicts a major squeeze on global margins with an estimated drop of 64 basis points, leading to $907 billion in lost profit. Companies pass $592 billion of this burden to consumers through price hikes. They absorb the remaining $315 billion themselves.

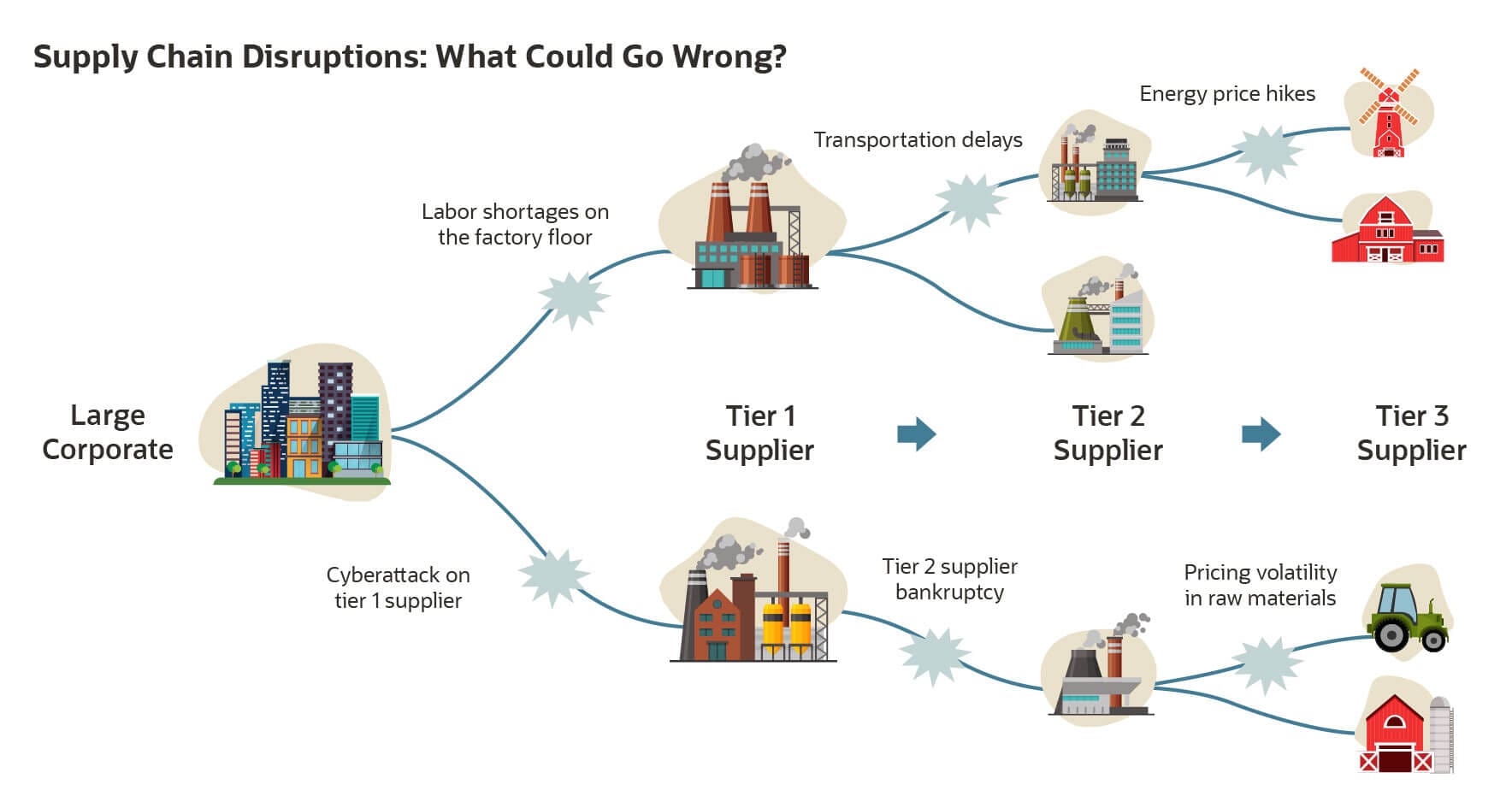

How supply chain disruptions affect cash flow

These disruptions create several cash flow problems that hurt operations:

-

Immediate cash drains: Companies face sudden expenses and delayed payments that create instant money problems

-

Revenue loss: Late product deliveries lead to missed sales and unhappy customers

-

Cash flow gaps: Money gets tied up in extra inventory and advance purchases, especially when companies buy materials in bulk to ensure supply

On top of that, customers often delay payments when they face their own money troubles. This creates extra pressure right when cash matters most. The effects ripple through supply networks and touch every part of the chain.

Why traditional models are no longer enough

Old supply chain models rely on predictable changes in supply and demand. They assume a stable world – something we no longer have. The just-in-time approach that cut inventory and optimized efficiency now makes companies vulnerable.

These old models don’t work well because they’re:

-

Disconnected due to poor communication between distant parts of the chain

-

Wasteful since messages must travel step by step down the line

-

Too slow to react when markets become volatile

So businesses now move from “just-in-time” to “just-in-case” strategies. A recent survey shows 43% of 500 U.S. companies would pay 10-20% extra for products delivered in one week instead of six. This shows how important quick access to inventory has become compared to pure cost savings.

The role of forecasting and visibility in liquidity optimization

Image Source: Biz Infograph

“The quality of your decisions is only as good as the quality of the data flowing through your supply chain.” — Kevin Comerford, VP Supply Chain, Cisco

AI-powered demand forecasting

AI enhances cash forecasting through three essential capabilities:

-

Automated data management – teams can focus on strategic decisions as errors decrease

-

Advanced pattern recognition – AI spots trends in historical data that humans might miss, from seasonal changes to evolving customer behaviors

-

Real-time monitoring – teams receive instant alerts when market conditions shift

These features help businesses predict incoming revenue based on actual sales forecasts and match accounts receivable projections with procurement schedules. The AI models utilize external data sources to ensure demand signals reflect market conditions accurately.

Real-time inventory and supplier data

Supply chain visibility strengthens financial planning by offering a complete view of production progress, order pipeline, and inventory movement. The importance of liquidity management has prompted 80% of companies to launch projects that improve their supply chain visibility.

Companies can balance inventory levels between facilities when they have end-to-end visibility, which reduces both overstock and stockouts. Better demand planning and data sharing lead to stronger supplier relationships.

Linking forecasting to cash flow planning

Cash flow forecasting helps companies plan their financing, investing, and operating activities with confidence. This forms the basis of a liquidity strategy that supports daily operations while reducing asset exposure and borrowing costs.

Companies can set dynamic minimum cash levels based on projected cash flow by connecting forecasting to financial planning. This comprehensive approach ended up enabling treasury teams to boost strategic collaborations through improved demand planning. Products stay ready to meet consumer demand, which drives higher cash flow and profit margins.

How supply chain finance unlocks working capital

Image Source: Journal of Cloud Computing – SpringerOpen

Supply chain finance (SCF) has become a great way to free up trapped capital and make working capital work better throughout the supply chain. SCF stands out from other treasury solutions because it tackles both sides of the cash flow equation at once.

What is supply chain finance (SCF)?

Supply chain finance, also known as reverse factoring, helps businesses pay their suppliers early through third-party funding. The main difference is that buyers, not suppliers, start the SCF process. Buyers approve supplier invoices that a bank or other outside financier can fund. This creates a win-win situation – suppliers get paid quickly, and buyers can take longer to pay.

Benefits for buyers and suppliers

Buyers get several important advantages:

-

Better working capital through longer supplier payment terms

-

Less risk of supply chain problems

-

Stronger supplier relationships and loyalty

-

Quick response to sudden demand changes

Suppliers also get great benefits:

-

Quick access to their money, usually within days of shipping

-

Lower costs thanks to the buyer’s better credit rating

-

More reliable payment schedules to plan cash flow better

-

Fewer days sales outstanding (DSO) without affecting current credit lines

SCF vs traditional financing

Traditional financing creates debt, but SCF frees up working capital by buying accounts receivable. Banks usually want collateral, long credit histories, and lots of paperwork for traditional loans, while SCF relies on the buyer’s credit score. The best part is suppliers never have to pay back the funding – the financial company collects straight from the buyer.

Speed of funding and digital platforms

Digital SCF platforms have changed how quickly and well the system works. Modern platforms work with ERP systems, so suppliers can join in minutes instead of weeks. These tech-driven solutions handle transactions automatically and watch over invoice approvals from start to finish. On top of that, some platforms let you switch between SCF and other options like dynamic discounting when business needs change.

Building a resilient and cash-efficient supply chain

Image Source: SlideTeam

Manufacturers today face a basic challenge. They must stay resilient without depleting their cash. A careful strategy helps build supply chains that can handle these opposing needs.

Balancing service levels with inventory

The age-old inventory puzzle continues – should companies keep extra stock to serve customers better or cut inventory costs and risk losing sales? This gets trickier as customers expect more and supply chains grow bigger. Companies now just need to rely on more product varieties while managing additional unique parts.

Companies must invest every dollar wisely to optimize their inventory. They can benefit by reaching and then shifting the service level-inventory investment curve. Success depends on knowing which products need better service levels – especially when you have high-margin items that affect profits by a lot.

Reducing carrying costs through smart replenishment

Storage costs add up faster and put financial pressure on manufacturers. These costs go beyond storage fees to include utilities, wages, maintenance, and security.

Smart replenishment technologies help by using up-to-the-minute data analysis to optimize stock levels automatically. This “Goldilocks” approach will give a perfect balance – not too much or too little stock. Days Inventory Outstanding (DIO) remains a vital metric, as lower DIO shows quicker inventory turnover and lower holding costs.

Improving supplier relationships through transparency

Strong supplier bonds are now central to supply chain strength. Value comes from working together, being open, and sharing goals rather than just cutting costs.

Companies that keep taking them showed higher growth, lower operating costs, and better profits than others in their industry. Building trust through openness and sharing information comes first. Next, organizations should have clear roles for teams on both sides. Finally, they should create shared value using tools like cleansheet cost modeling to discuss improvements based on facts.

Using liquidity to fund growth initiatives

Supply chain optimization frees up money for strategic investments. Companies can use this capital to reshape the scene with modern technology and improve core business processes. They might also boost research to develop new products and gain market share.

Beyond internal growth, companies can enter new markets or reach different customers to vary their income sources and lower risks. Those looking to grow faster can buy strategic businesses that fit their model while creating savings and improving cash flow.

Conclusion

Liquidity optimization has grown beyond a financial convenience to become a must-have strategy for supply chains worldwide. Businesses that adapt to these changes gain an edge over competitors who stick to outdated approaches. Traditional models worked well in the past but fall short in today’s unpredictable economic world.

Two critical pillars drive successful cash flow management: better forecasting capabilities and detailed supply chain finance solutions. AI-powered forecasting tools give businesses the visibility they need to spot challenges before they affect operations. Supply chain finance programs create situations where both buyers and suppliers win – buyers can extend payment terms while suppliers get paid faster at better rates.

Smart inventory management balances service levels with carrying costs to build truly resilient supply chains. Businesses must choose which products deserve priority and which suppliers warrant closer partnerships. This balanced strategy keeps cash flowing while operations stay effective.

Organizations can use the extra liquidity from these improvements to propel development through digital upgrades, market expansion, or strategic buyouts. Those who become skilled at liquidity optimization can weather economic storms and build strong foundations for future success.

Supply chains keep changing under economic pressure. Businesses that treat their supply networks as strategic assets rather than cost centers will thrive without doubt. Liquidity optimization stands out as the hidden advantage that sets industry leaders apart from those just trying to stay afloat.

Key Takeaways

Modern supply chains face unprecedented liquidity challenges, but strategic optimization can transform cash flow from a constraint into a competitive advantage.

• AI-powered forecasting delivers 90% quarterly accuracy, enabling precise cash flow planning and reducing inventory carrying costs through smart replenishment strategies.

• Supply chain finance unlocks working capital by allowing suppliers early payment while buyers extend terms, creating win-win scenarios that strengthen relationships.

• Real-time visibility across operations connects demand forecasting to cash planning, helping businesses balance service levels with inventory investment efficiently.

• Strategic liquidity optimization frees capital for growth initiatives like digital transformation, market expansion, and acquisitions rather than just survival.

• Collaborative supplier relationships outperform cost-cutting approaches, with transparent partnerships delivering higher growth and lower operating costs than industry peers.

The shift from “just-in-time” to “just-in-case” supply chains requires viewing your network as a strategic asset rather than a cost center, positioning leaders to thrive while competitors merely survive economic uncertainty.

FAQs

Q1. What is liquidity optimization in supply chain management? Liquidity optimization in supply chains involves strategies to improve cash flow and working capital efficiency. It includes techniques like AI-powered forecasting, supply chain finance, and smart inventory management to balance service levels with costs while freeing up capital for growth initiatives.

Q2. How does supply chain finance benefit both buyers and suppliers? Supply chain finance creates a win-win situation. Buyers can extend their payment terms, improving working capital, while suppliers receive faster payments at favorable rates. This arrangement strengthens relationships, reduces supply chain disruptions, and provides better cash flow predictability for both parties.

Q3. What role does AI play in supply chain forecasting and liquidity management? AI-powered forecasting tools can achieve up to 90% quarterly accuracy in cash flow predictions. They automate data management, recognize complex patterns, and provide real-time monitoring of market conditions. This precision enables businesses to make informed decisions about capital allocation and operational spending.

Q4. How can companies balance inventory levels with customer service? Balancing inventory and service levels requires understanding which products demand higher service levels, particularly high-margin items. Companies should aim to reach the optimal service level-inventory investment curve, then work on improving it. Smart replenishment technologies using real-time data and predictive analytics can help automate this process.

Q5. Why is supplier collaboration important for supply chain resilience? Strong supplier relationships are crucial for supply chain resilience. Companies that regularly collaborate with suppliers often demonstrate higher growth, lower operating costs, and greater profitability. This collaboration involves building trust through transparency, cross-functional engagement, and pursuing shared value through mechanisms like cleansheet cost modeling.