Cash Flow Projection Secrets: Expert Tips to Prevent Business Cash Crunches

The numbers paint a concerning picture. About 49% of finance professionals doubt their cash flow data’s reliability, which can get pricey for their companies. We’ve seen this problem firsthand. Your business needs accurate cash flow projections to spot potential shortages early. This piece gives you the knowledge to create reliable projections, whether you need a basic template or want to learn the proper forecasting method.

Good forecasting lets you see your financial future clearly and spot crucial surpluses and shortages. On top of that, it helps achieve treasury goals like managing debt, securing funding, and propelling business growth. Our expert tips in this piece will help prevent cash crunches. You’ll also find practical examples of cash flow analysis that can reshape your financial planning approach.

Understanding Cash Flow Projections

A cash flow projection works like your financial crystal ball—a forecast that estimates future cash inflows and outflows over a set period. Your cash flow projection looks forward while financial reports look backward. This approach lets you take action instead of just reacting.

What is a cash flow projection?

Your cash flow projection maps expected cash movements through a chosen timeframe—monthly, quarterly, or yearly. The estimation relies on predicted revenue, expenses, and payment timing. This financial navigator warns you about potential problems or opportunities ahead, so you can make smart decisions about your business’s future.

A good projection shows both expected income with predicted receipt dates and costs with their payment schedules. Picture it as reading your business’s financial pulse—tracking money that flows in from sales and investments and flows out for expenses, debt repayments, and operating costs.

How it is different from cash flow statements

Cash flow statements document historical data—they show where your money has already gone. The main differences come down to timing and purpose:

- Time orientation: Statements show past performance; projections look at future expectations.

- Accuracy level: Statements give exact historical records; projections provide educated estimates.

- Core function: Statements analyze past events; projections plan for future possibilities.

These differences matter because each financial tool serves a unique need—statements help you understand what happened while projections guide your future decisions.

Why projections matter for business survival

Research shows that all but one of these business failures happen because companies run out of money. Cash flow projections work as your early warning system for financial trouble.

Cash flow projections help you:

- Spot potential cash shortages early

- Get ready for tight resource periods

- Keep enough cash to pay staff and suppliers on time

- Make solid decisions about growth and investments

Your projections let you act with confidence instead of guessing. You can predict cash crunches months ahead and get valuable time to find more funding, adjust payment timing, or cut costs.

8 Expert Tips to Prevent Cash Crunches

Businesses need proactive management and smart planning to prevent cash flow problems. Cash flow disruptions affect 88% of small businesses, but only a third of them take steps to fix these issues. Here’s how you can stay ahead of potential cash crunches.

1. Use a cash flow projection template to keep things in order

A good template makes cash flow projection simple and straightforward. Your template should have sections for income sources, expenses, net cash flow, and forecasted periods. This setup gives you a clear framework that makes data entry and analysis easier, helping you spot potential gaps early.

2. Forecast multiple scenarios: best, worst, and expected

You should create and analyze different scenarios to understand possible outcomes and their cash implications. This way, you’ll be ready for anything from unexpected downturns to growth opportunities. Your base case shows likely outcomes, while best and worst cases help you see the full range of possibilities.

3. Monitor accounts receivable and payable closely

Your accounts receivable directly shapes business relationships and working capital efficiency. You can spot payment trends early by tracking outstanding invoices through aging reports. Smart timing of accounts payable will improve your cash conversion cycle without hurting vendor relationships.

4. Include capital expenditures and one-time costs

Capital expenditure schedules do two key things: they feed depreciation to income statements and CapEx to cash flows. Many businesses don’t factor these major expenses into their projections, which leads to surprise cash shortfalls. One-time costs can also throw off cash flow when not properly predicted.

5. Update your projections regularly

Cash flow projections need constant updates – they’re not “set and forget” documents. Regular comparison of actual versus forecasted cash flows helps identify variances. This practice lets you adapt to unexpected changes and keeps your financial planning on track.

6. Use rolling forecasts to stay nimble

Rolling forecasts give you ongoing insight over a specific timeframe, unlike traditional yearly budgets. This method lets you recalibrate based on your key business drivers in live time. The result is faster reforecasting and better accuracy.

7. Use automation tools for better accuracy

Automated cash flow forecasting turns a time-consuming process into an optimized system by pulling live data from multiple sources. Smart algorithms check data inputs and catch inconsistencies before they affect your forecasts. This reduces errors and gives your team more time to focus on strategic decisions.

8. Match projections with strategic goals

Your cash flow projections should provide a financial framework that supports your company’s goals. This connection makes sure every dollar you track helps move your business forward. Good projections help you make smart decisions about investments, expansions, and cost management that fit your long-term vision.

Common Pitfalls and How to Avoid Them

Your best-laid financial plans can still fail. Spreadsheets contain errors 90% of the time that could derail your cash flow projections. You can create more reliable forecasts and prevent cash crunches by understanding these common pitfalls.

Overestimating revenue or underestimating expenses

Businesses often project higher sales than their historical achievements due to optimism bias. This false sense of security can trigger overspending and serious cash shortages. Your projections should rely on historical data and market trends instead of best-case scenarios.

Operating reserves can deplete faster when expenses are underestimated. You should add a 5-10% buffer to expected costs and track payment timelines to avoid cash flow bottlenecks.

Ignoring seasonal trends and market moves

Poor resource allocation and cash flow problems emerge when you overlook seasonal patterns. Companies with seasonal fluctuations see revenue drops of 30-40% during off-seasons. This creates financial strain since fixed costs stay constant.

You should analyze several years of financial data to spot trends. Products that cause seasonal spikes and customer ordering patterns need careful attention. This knowledge helps you build adequate reserves during peak periods.

Relying too heavily on spreadsheets

Spreadsheets create many problems in cash flow forecasting despite their convenience. Approximately 88% of spreadsheets contain some form of error. These mistakes often result in wrong decisions with severe risks.

Spreadsheets lack immediate data connections. This creates a gap between business condition changes and your ability to act. Your competitors who use automated forecasting platforms can spot trends weeks earlier.

The answer lies in purpose-designed planning and forecasting software. These tools deliver complete, accurate financial projections and eliminate manual errors that plague spreadsheet-based forecasting.

Tools and Templates to Improve Accuracy

The right tools can revolutionize your financial planning process. A 15% improvement in forecast accuracy can deliver a 3% or higher pre-tax improvement in business performance.

Simple cash flow projection tools for small businesses

Small businesses starting with cash flow management have several available options. Float syncs with major accounting platforms at around $20 per month. Xero’s built-in cash flow tool provides 7-day and 30-day forecasting views with your subscription. QuickBooks Online users get access to their native tool that forecasts up to 12 months ahead.

Advanced forecasting software for growing companies

Growing businesses can use Datarails which provides Excel-based forecasting with direct connections to ERPs and banking systems. Workday Adaptive Planning supports complex multi-year financial models and makes shared work easier. Anaplan gives enterprises highly customized models that handle multiple dimensions within one system.

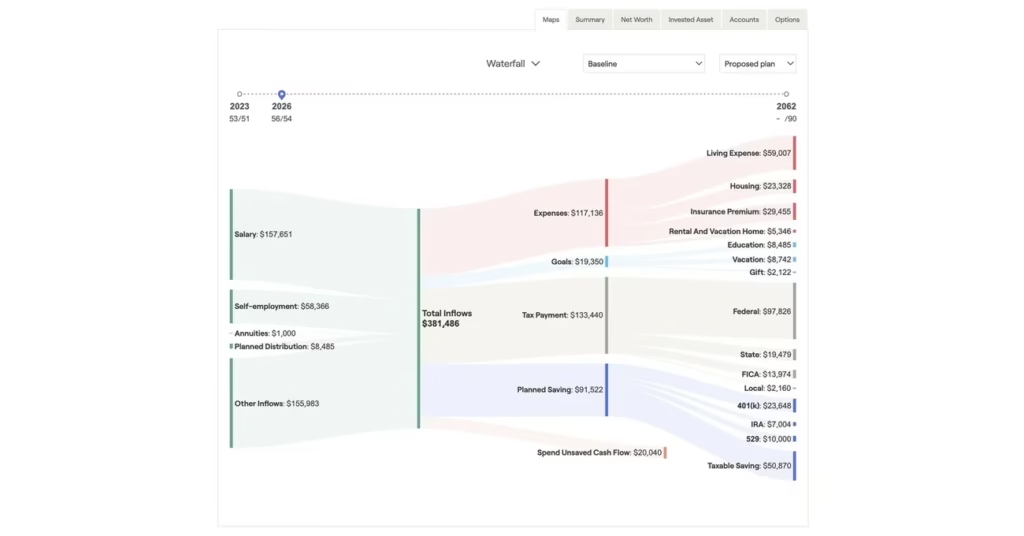

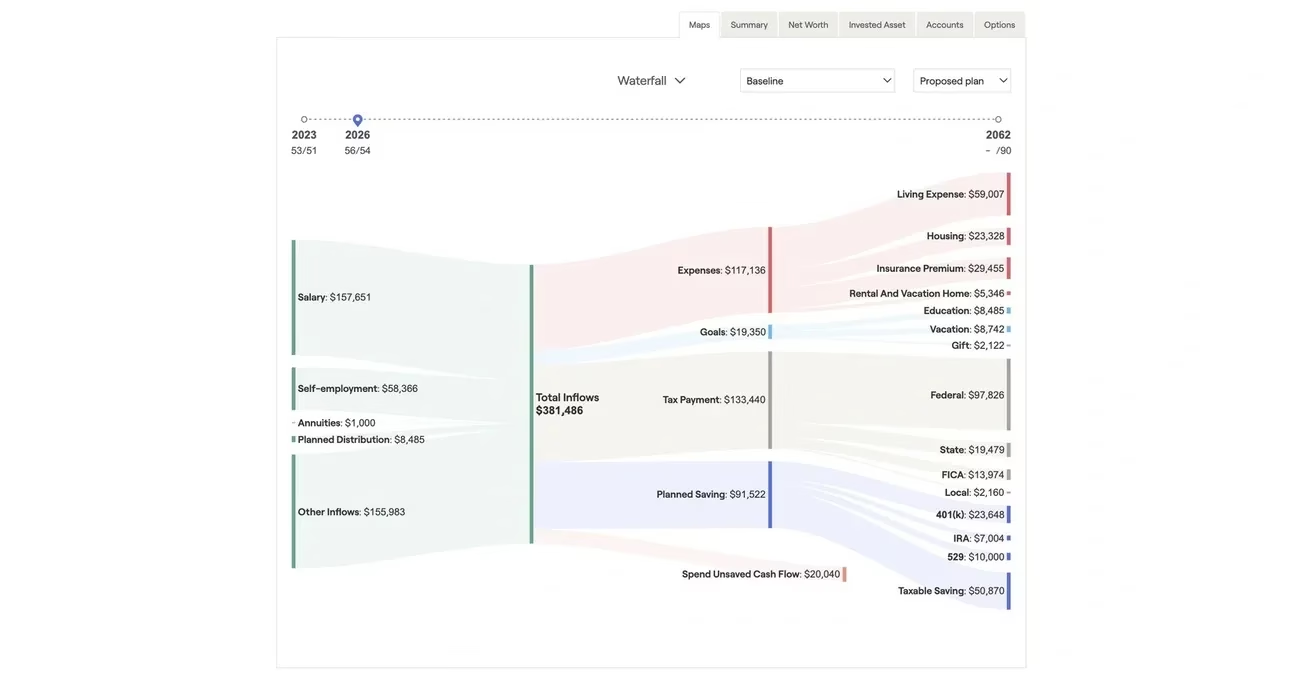

Cash flow projection example: what a good one looks like

A well-laid-out projection has opening balance, clearly categorized cash inflows and outflows, and calculated net cash flow. Pizza Planet’s example shows this perfectly: they started with a $50,000 opening balance in March and tracked receivables collection spikes in April. The company added strategic buffer cash in May/June, made loan payments, and ended up showing steady growth in closing balance. Good projections use rolling forecasts where teams update figures based on actual performance regularly.

Conclusion

Cash flow projection is a vital lifeline for business survival. The numbers tell a stark story – 82% of failed businesses went under because they couldn’t manage their cash flow properly. This piece explores proven strategies that turn financial uncertainty into predictable patterns and protect your business from unexpected shortfalls.

Projections and statements serve different purposes. Statements show where your money went, while projections map out where it’s heading. This forward-looking view gives you valuable time to adapt before issues surface.

Your business shouldn’t become another statistic. The eight expert tips we’ve covered will boost your financial visibility by a lot. Simple steps like using well-laid-out templates and creating multiple scenarios make a real difference. On top of that, you’ll get better forecasting results when you avoid common mistakes like overestimating revenue or overlooking seasonal patterns.

Tools can make or break your success. Small businesses often find Float works well, while growing companies might need advanced platforms like Workday Adaptive Planning. Automated forecasting helps you dodge the errors that often crop up in spreadsheet-based methods.

Cash flow projection isn’t just about numbers – it’s your survival toolkit. Spotting potential cash shortages early lets you secure extra funding, adjust payment timing, or cut costs before problems hit. These strategies will help you turn cash crunches into manageable situations and set your business up for green growth.

Key Takeaways

Master these essential cash flow projection strategies to protect your business from the 82% failure rate caused by cash flow mismanagement.

• Create multiple scenarios (best, worst, expected) and update projections regularly to anticipate cash shortages before they become crises • Monitor accounts receivable and payable closely while including capital expenditures to maintain accurate working capital visibility • Use rolling forecasts and automation tools instead of error-prone spreadsheets to improve accuracy by 15% and boost performance by 3% • Avoid overestimating revenue and ignoring seasonal trends—add 5-10% expense buffers and analyze historical data for realistic projections • Align cash flow projections with strategic goals to ensure every financial decision supports long-term business growth and sustainability

Effective cash flow projection transforms reactive financial management into proactive business strategy, giving you the precious time needed to secure funding, adjust operations, or implement cost-saving measures before cash crunches threaten your business survival.

FAQs

Q1. What is a cash flow projection and why is it important for businesses? A cash flow projection is a forecast that estimates future cash inflows and outflows over a specific period. It’s crucial for businesses as it helps predict potential cash shortages, plan for resource-limited times, and make informed decisions about growth and investments.

Q2. How often should I update my cash flow projections? Cash flow projections should be updated regularly. It’s recommended to compare actual cash flows to forecasted figures frequently and adjust accordingly. This practice helps you adapt to unforeseen circumstances and ensures your financial planning remains accurate and relevant.

Q3. What are some common pitfalls in cash flow projections? Common pitfalls include overestimating revenue, underestimating expenses, ignoring seasonal trends and market shifts, and relying too heavily on spreadsheets. These mistakes can lead to inaccurate projections and potential cash flow problems.

Q4. Are there any tools that can help improve the accuracy of cash flow projections? Yes, there are various tools available for different business sizes. Small businesses can use simple tools like Float or QuickBooks Online, while growing companies might benefit from more advanced software like Datarails or Workday Adaptive Planning. These tools can significantly improve forecast accuracy and reduce manual errors.

Q5. How can I align my cash flow projections with my business’s strategic goals? To align projections with strategic goals, ensure that your cash flow forecasts support your company’s long-term vision. Use projections to make decisions about investments, expansions, and cost management that are in line with where you want the business to go. This alignment ensures that every dollar you track supports your overall business strategy.